October Austin Real Estate Market Report

October 13, 2015 by Laura Duggan · Leave a Comment

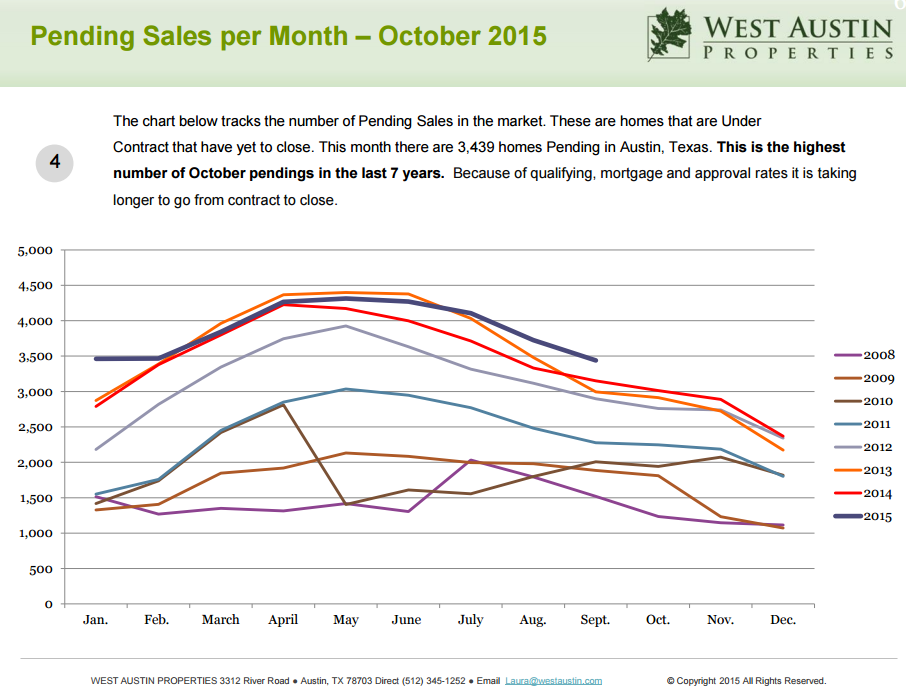

As the days get shorter, Austin home sales are following normal Fall patterns with fewer sales and more days on market than other times of the year for most areas and price ranges. However, even though sales have declined for the past two months as they do this time of year, the market is still strong especially in the lower price points. The actual number of sales in September was highest of any September. August homes were on the market for the fewest days in Austin history pushing the number of pending home sales to the highest number of any September.

As the days get shorter, Austin home sales are following normal Fall patterns with fewer sales and more days on market than other times of the year for most areas and price ranges. However, even though sales have declined for the past two months as they do this time of year, the market is still strong especially in the lower price points. The actual number of sales in September was highest of any September. August homes were on the market for the fewest days in Austin history pushing the number of pending home sales to the highest number of any September.

Of the 4409 homes for sale valued at less than $500,000, almost half of them sold in September. This makes this price point an Extreme Seller’s Market with an average of only 2.1 months of inventory. Months of inventory increases as the price point increases. See Sales by Price Band in our full report.

The very upper end of the market is not performing nearly as well. Of the 941 homes for sale over $900,000, only 63 sold in September giving us an average of 15 months of inventory. That is if no other homes came onto the market in this price range, it would take 15 months to sell them all. We call anything over 12 months an Extreme Buyer’s Market. At that rate, there is downward pressure on home prices while sellers compete for the next sale.

For the past three years we have seen overall appreciation in the Austin market, but this trend is slowing. The price increase in 2013 was 8.9%, in 2014 it was 7.1% and so far this year it has been 4.6%. Low interest rates and a robust job market have fueled the demand and appreciation for the past 3 years.

What could change all of that? Real estate is, after all, cyclical. Lots of factors can lead to a dip in the market or at least further slowing of sales and appreciation. Some factors to watch are led by an increase in interest rates promised by the Federal Reserve Board for later this year. It wouldn’t surprise me if they started taking them up this month. A rise in rates usually impacts our stock market negatively and causes buyers in the upper end to be more cautious slowing sales in the segment. Falling oil prices could also be a factor especially here in Texas as jobs are lost in related industries. Look for job layoffs as a signal. Thankfully, we aren’t as oil dependent as we once were in our economy.

As always, we are happy to consult with you on the purchase or sale of a property here in the Austin area. We watch the market closely and are ready to serve you with all of your real estate needs. To look at the market by price band and zip code, take a look at our full October Real Estate Market Report.

Posted by Laura Duggan, Broker, West Austin Properties, 3312 River Road, Austin, TX 78731. 512-750-2425 or laura@westaustin.com